Payday Loans, No Credit Check, No Employment Verification

The options are limited when trying to acquire a loan with no credit checks and no employment verification. Does that mean it’s impossible? Nothing is impossible with online lending!

In this post, we cover everything you need to know about no credit check and no employment verification loans, so stick around.

What Are Payday Loans with No Credit Check or Employment?

As complicated as “no credit check and no employment verification payday loans” sounds, they’re quite straightforward. Basically, these are loans aimed at people who are currently unemployed.

Such bad credit loans may or may not require a credit check, depending on the lender you’re dealing with. Now, bear in mind that there aren’t a lot of lenders who are willing to lend money to people who aren’t receiving a regular income via employment, so your quest to acquire a loan might take a while.

Payday loans no credit check no employment verification and no employment verification range from $300 to $10,000. Payday loans weekend payout ranging from $300 to $2,000 are considered small easy loans no bank statement that don’t require security.

Medium and large loans, which are the ones ranging from $2,001 to $10,000 require some sort of asset security. It can be anything from home equity to a car title.

Through our practical knowledge, small loans are typically associated with a 20% establishment fee and a 4% monthly, whereas medium and large loans come with an APR that’s inclusive of all fees and charges.

Who Can Receive Payday Loans?

Based on our firsthand experience, Payday loans aren’t limited to the unemployed or people who don’t have their financial affairs in order; they’re basically accessible to anyone who needs fast cash.

For instance, you might be in an emergency that requires you to deal with it via credit, and your credit score isn’t really working in your favour. Instead of having to wait for a traditional lender like a bank or credit union to process you a loan online no credit check instant approval, which can take weeks, you can apply for an online payday loan for bankrupts and get your funds in under 24 hours.

Simply put, the whole online lending market is aimed at people who are in need of fast cash and who are able to repay their loans, regardless of their credit score, employment, and so forth.

One thing you should keep in mind, however, is that there’s no such thing as guaranteed loan approval; at least in Australia. This is in accordance with the National Consumer Credit Protection Act of 2009.

The laws and regulations stated in this act are in place to establish responsible lending and to protect borrowers from the hardships of having to repay quick cash loans on weekends they weren’t fit for.

Lenders that advertise guaranteed loan approval are most likely running some sort of scam. The scam may involve excessive fees and interest, or it may involve unfair or illegal terms.

To determine whether or not a lender is legit, make sure they’re listed with the Australian Securities and Investments Commission (ASIC). Also, make sure they’re not on the ASIC’s “do not deal with” list.

How Fast Can I Get a Payday Loan?

Drawing from our experience, one of the perks that online lending has over traditional lending is that it’s extremely fast. Instead of waiting weeks for a bank or credit union to process your loan application, online lending enables you to apply for a loan from the comfort of your home.

Once approved, your funds will arrive within 24 hours. Some lenders are so fast at processing applications that you may receive your funds in under 60 minutes.

Forget all about phone calls, financial documents, and weeks of waiting. All you need to do is fill a short online form with some of your personal and financial details, sign an electronic contract upon the approval of your application, and enjoy your loan.

What Are the Risks Associated with Payday Loans?

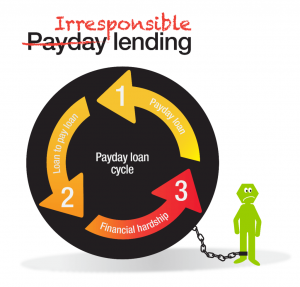

Just as there are perks to payday loans, there are also a few downsides, especially compared to personal loans.

Payday loans, which some lenders label as cash advances, come with notably high fees. Not only that, but they also come with inflexible repayment terms that are typically much shorter than the repayment terms associated with personal loans.

To add, if you apply for a payday loan with no credit checks and no employment verification, your chances of acquiring more than $2,000 are pretty slim.

What Are the Eligibility Terms for Payday Loans?

The eligibility criteria for high acceptance rate payday loans direct lenders tend to vary from one lender to another. However, most lenders require borrowers to be over the age of 18 and permanent residents of Australia. Further, you’ll need an active phone number, email address, and bank account.

Final Thoughts

Your chances of acquiring a payday loan with no credit checks and employment verification may be non-existent when resorting to a traditional lender, but with online lending, it’s very feasible.

Note that not all lenders choose to bypass credit checks. But don’t worry; the decision-making process with most online lenders isn’t entirely based on credit scores. As long as you’re able to repay your loan, you shouldn’t have a hard time acquiring one.