No Credit Check Loans

If you have bad credit and you need money to cover your cash shortfall, the first thing that comes to mind is no credit check loans. But you may have another option. Perfect Payday is a lender finder service that may be able to pair you with a lender that offers bad credit loans that approve everyone from $300 to $10,000. However, we cannot provide you an assurance that your credit provider you’re matched with will offer a no credit check loan.

Drawing from our experience, Perfect Payday cannot guarantee that your lender will not perform a credit check. Each lender is a company on their own and whether or not they conduct credit checks will depend on their assessment policy. Therefore, Perfect Payday don’t have any control over the assessment of loan applications.

Do you have poor credit history? Why don’t you consider using Perfect Payday’s lender-finder service?

What you need to know about no credit check loans?

Lenders offer these small loans without conducting a credit check. To be more specific:

- Lenders won’t check your credit history

- Your personal loan details will be added to your credit check

- PTY LTD Lenders will check your bank statements with the last 3 months

As indicated by our tests, Borrowers who have subpar credit scores often turn to short term personal loans for bad credit. Traditional lenders, which always conduct credit checks, often decline the easy financial loan applications of borrowers who have a poor credit history.

Even if that’s the case, there are other instant unsecured loans out there. You may still apply for a bad credit personal loan today. However, if you choose to submit an application with us, please remember that Perfect Payday cannot guarantee that the lender you’re paired with won’t conduct a credit check.

What happens when I apply for a no credit check loans?

If you apply for a 10000 loan no credit check, here are a few things you need to know:

- The lender won’t check on your credit report. As its name suggests, the lender that offers this type of credit won’t request access to your credit history.

- The details of your micro loans will still be added to your credit file. Also, even if your lender didn’t request to access your credit file, it will still inform the credit check bureau about your overnight loan application. Whether you’re approved or not, the loan details will be recorded on your credit file.

- Lenders will check your banking history. To be more specific, they would check your records over the last three months to determine if you can afford the loan or not. This will also help your lender evaluate your current financial status.

- You must have a regular income. It’s not enough for you to say that you have a source of income. You need to provide proof, which could be through employment or through regular Centrelink benefits.

You may be able to get the fast cash you need the same day you submitted your application; but this would depend on the lender you’re paired with.

Where can I find fast no credit check loans?

Applying for this micro cash loan doesn’t cost a thing, either during application process or once the application is approved. Not only that, you may be paired with a lender in just 60 minutes. Whether you borrow $300 or $10,000, it’s the lender’s decision to check your credit history or not.

Generally speaking, Perfect Payday can’t give you a 100% guarantee whether a credit check will be performed or not. Despite that, the lenders we work with will not just base their decision on your credit history but also consider how you deal with money these days.

Is it safe to take out no credit check loans?

There are countless credit options available to consumers. A few loan products you’ll find are best payday loans and personal loans.

Our findings show that, with Perfect Payday, you no longer have to sift through all the options provided by different credit providers. We’ve made the process of finding a lender easier and more convenient. We’ll pair you with one that’s known for its reputable lending practices.

Just remember that it’s up to the lenders whether to conduct a credit check or not. Even if they do, other factors will be taken into account. So, even if you have a subpar credit record, Perfect Payday may still find you a lender that could look past it and probably offer you a needy money loan today.

Can you pair me with lenders that won’t check my credit history?

Lenders these days almost always conduct a credit check. As we mentioned earlier, we cannot guarantee that your credit history won’t be assessed. What we can do, instead, is match you with a lender that may still offer you a loan even if you have a substandard credit history.

Below you’ll find a list of loan products that may not require a credit check. Please be reminded that this serves only as a guide and it’s still the lender’s prerogative whether to perform a credit check or not.

Where can I find guaranteed loans for bad credit?

We cannot assure you that you’ll find guaranteed loans for bad credit. In the legal world, a guaranteed approval loan isn’t allowed.

The Perfect Payday Alternative To No Credit Check Loans

If you apply with Perfect Payday, we strive to pair you with credit providers that provide loans for people with bad credit. So, why don’t you consider using Perfect Payday’s lender-finder service if you are looking for a loan that doesn’t require a credit check.

Apart from that, submitting an application on our website is very easy. You can do it in just a few minutes and once you hit apply, we’ll then do our job and try to pair you with a lender. Eliminate the hassle that’s associated with traditional loans and turn to Perfect Payday for easy loans for bad credit.

Where can I find no credit check loans?

First of all, you have to apply for a loan with an online cash loan lender. You either have to visit their office to fill out their application form. Then, you’ll be asked to submit your payslips, bank statements, and provide proof that you have a source of income. Consumers prefer payday lenders because they can get access to the money they need easily and quickly.

However, short term no income proof loans and microloans are the common products offered by payday lenders. Moreover, Perfect Payday can’t assure you that we can pair you with a lender that offers centrelink disability pension loans without a credit check. What we can do for you instead is to match you with reputable and responsible short term lenders. PTY LTD may still decide to approve your loan application even if you have a bad credit history.

Can I get a loan with no credit check?

If you want to find a lender that provides a loan without a credit check, use the lender finder service of Perfect Payday. These credit providers may even help you improve your bad credit.

The lenders we work with don’t just consider your credit history but also your current financial status and how you handle your finances.

Perfect Payday understands that people go through unexpected financial troubles at some point. That’s one of the reasons why we’ve associated our self with credit providers that consider other facts aside from your credit history. Even if we cannot guarantee that no credit assessment will be done, we can still do our best to pair you with one that may offer you a cash loan advance.

Perfect Payday’s network of lenders may offer no paperwork loans ranging between $300 and $10,000. What are you waiting for? Apply now with Perfect Payday and get a no credit check loan today.

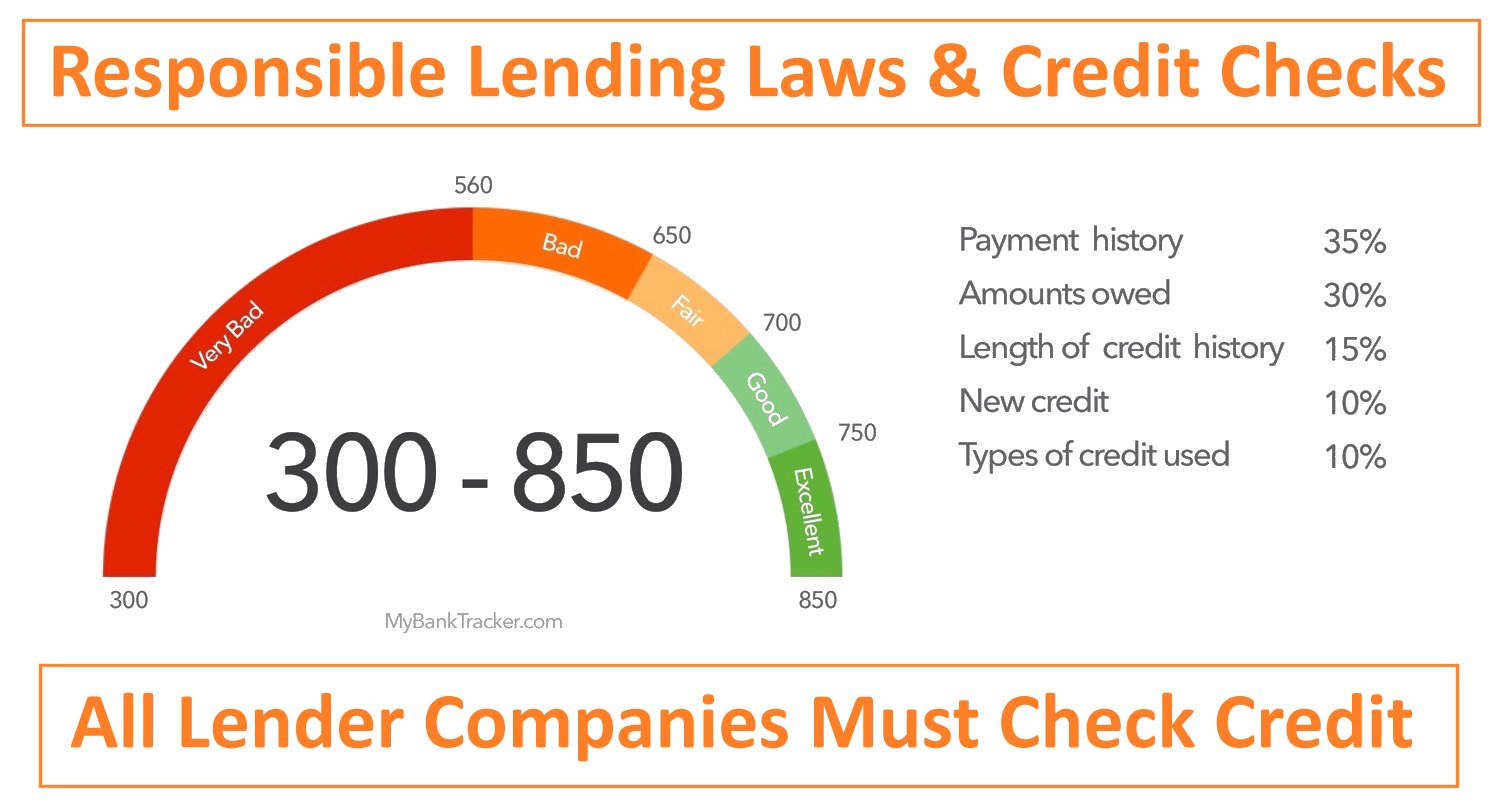

What does my credit score mean?

Your credit file is analysed in order to determine your credit score. Lenders use it to get an idea of whether you are credit worthy or not.

Depending on the agency you use, your credit score may range between zero to 1000 or zero to 1200. Here’s how lenders evaluate your credit score.

Five Credit Bands:

1. Excellent

- Experian : 800-1,000

- Equifax : 833-1,200

2. Very good

- Experian : 700 – 799

- Equifax : 726 – 832

3. Good

- Experian : 625 – 699

- Equifax : 622 – 725

4. Average

- Experian : 550 – 624

- Equifax : 510 – 621

5. Below average

- Experian : 0 – 549

- Equifax : 0 – 509

Credit score bands refer to the possibility of an adverse event being added to your credit check file over the next 12 months. For instance, an excellent credit score means it is highly unlikely that an adverse event will happen in the next 12 months. Meanwhile, an average credit score means that the consumer is likely to face an adverse event that won’t allow you to get a loan fast.

Adverse events include debt agreements, court judgements, defaults, and more.