Loan Application Process

Houses can be expensive, and not everyone is financially able to get the house of their dreams with prices skyrocketing. That’s why banks are there – to lend money to those who need it to aid them in their home purchase.

However, a bank won’t just give you the money; they need to know your financial status to determine if you’ll be able to pay back the money. Only then will you get to repay the bank in instalments each month. Learn how to pay off loans fast here.

Overall, applying for a loan can be a long and arduous process. With that in mind, you need to be aware of what each step entails and what documents you’ll need during the process. If you need loans been refused everywhere, apply for a loan today with Perfect Payday.

The 6 Steps of the Loan Application Process

For the bank to lend you the money you need, they need verification of your identity and information about your earnings and expenses, which they verify through a loan application process that requires various documents. Learn loan meaning here.

To be precise, here are the exact steps you should expect during your loan application process.

1. Initial Meeting

For starters, you want to arrange for a meeting with a bank lending specialist. This is particularly important so that you can discuss with them the type of loan you’re looking for, their offerings, the interest rates associated with obtaining the loan, and how getting a mortgage loan impacts your credit history. Learn more about what is defaulting on a loan here.

It’s also during this meeting that you communicate how much money you currently have on hand to deposit and how much you want to borrow, upon which the bank calculates your LVR (loan to value ratio), which ultimately determines interest rates and charges, including LMI (lenders mortgage insurance). Learn what a paid default loan is here.

2. Filling in the Application

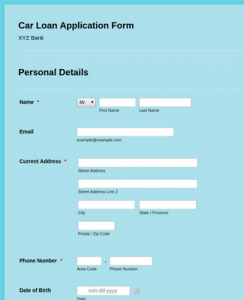

Once you’ve agreed with the bank on the suitable loan for you, you’re able to fill in the application for a home loan and submit it to the bank’s system. If needed, a valuation of the property you’re interested in will be requested.

3. Conditional Approval

Following that, the bank carries out an assessment of your capability of repaying the loan, including the interest. In many cases, you’ll get initial approval, which is called conditional approval. Learn how to calculate interest on a loan here.

As its name implies, your loan is approved but with conditions, such as a satisfactory valuation of the property. Receiving the conditional approval usually takes between 3 to 5 days if all documents are submitted on time.

Required Documents:

- ID

- Payslips

- Bank account statements

- Expenses and liabilities

After you obtain your conditional approval, that’s the starting point to obtaining your actual loan.

4. Property Valuation

At this point, your mortgage broker will go to the property for valuation and dealing with the current tenants, arranging for a visit and arriving at an agreement with them for you to get the property. Learn about loans for 17 year old here.

This step can take some time since it depends on the tenants agreeing on a date for inspection and not delaying the process. On average, it could take up to one to two weeks for property valuation to finalize. Can you get multiple payday loan? Learn more about multiple payday loans here.

Upon completion, your mortgage broker will submit the details to the bank, which will then start working on getting your unconditional approval.

5. Unconditional Approval

During this step, the lender (bank) reviews your documents again in tandem with the property valuation details. This takes from one day to one week, depending on the situation.

If everything checks out and the bank finds you eligible for a loan, they issue an unconditional approval, and that’s the final step. They’ll send you a contract to sign, and then a settlement is booked. In most cases, the documents and contract need to be signed by not only you but also guarantors, if any. Perfect Payday offers payday loan services.

6. Settlement

Finally, your lender will let your solicitor or conveyancer know that you’re ready for settlement, and they’ll contact you once a settlement date has been decided. Learn how do personal loans work here.

When that happens, you’ll be able to collect the keys and enjoy your new home. You’ll just have to start paying the bank each month based on the agreement you signed but from the comfort of your new home. Learn how to calculate interest rate on a loan here.

Conclusion

If your dream home is out of your financial abilities, you should certainly apply for a loan. Going through the loan approval process may take some time, but it’ll ensure your transition into your property of choice. Learn how to get approved for a loan here.

For the loan application process, you’ll need to provide your ID verification, payslips, bank statements, expenses, and liabilities, all for the bank to decide if you’re eligible to get a loan and will be able to pay it back. Learn the difference between a secured vs unsecured loan here.

The property of your choice is valuated, and an agreement is made with the tenants to get your application approved and hand you the keys. Just make sure you have all your documents ready and stay in contact with your mortgage broker and your solicitor or conveyancer since they’ll be the mediator between you and the bank. Learn how long to pay off loan here.